From Reforms To Ruins: The IMF’s Role in Collapsing Pakistan’s LNG Market And Export Viability

admin

June 4, 2025

Writer: MR. ASIM RIAZ AN ESTABLISHED ENERGY EXPERT, M.PHIL. STRATEGIC STUDIES NDU,MASTERS IN ENERGY MANAGEMENT CIIT, B.SC. (MECHANICAL) UET, BS. MATH-PHYSICS PU.

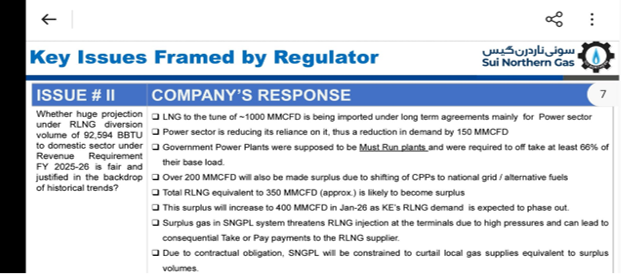

Through the Captive Gas Levy Act, it has imposed a forced transition from efficient, decentralized LNG-based captive generation to the centralized grid—even as coal-fired CPEC plants remain under-dispatched. This distortion not only worsens energy inefficiency and environmental degradation but also undermines Pakistan’s industrial capacity to meet international climate compliance standards such as the EU’s Carbon Border Adjustment Mechanism (CBAM), jeopardizing export viability. The fallout is visible in the gas market: demand destruction of approximately 3 MTPA or 400 MMCFD of RLNG from the industrial captive sector has triggered a full-blown supply crisis.

SNGPL alone is now saddled with a surplus of 450 MMCFD—translating into 54 out of 120 contracted cargoes effectively stranded (Slide attached along with petition Summary). With take-or-pay LNG contracts in place and no viable off-takers, the financial viability of the gas chain is in jeopardy.

Recent Posts

News

Blog

Have Any Question?

- +92 51 2726971

- info@ptc.org.pk