Annual Meeting of Pakistan Textile Council – 30th August 2025 – Karachi

Pricing Out Efficiency: How Misguided RLNG Tariffs Are Sinking Industrial Growth

admin

June 11, 2025

Blog

Writer: MR. ASIM RIAZ AN ESTABLISHED ENERGY EXPERT, M.PHIL. STRATEGIC STUDIES NDU,MASTERS IN ENERGY MANAGEMENT CIIT, B.SC. (MECHANICAL) UET, BS. MATH-PHYSICS PU.

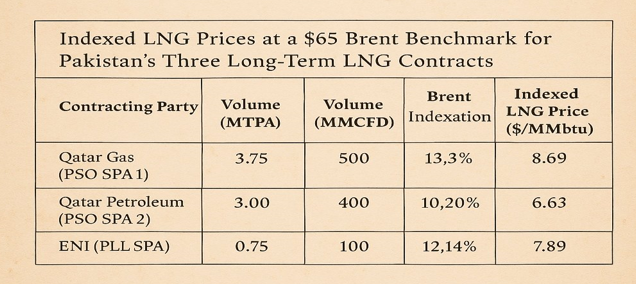

Pakistan’s long-term LNG SPAs, totaling 7.5 MTPA (approximately 1 Bcfd), yield a weighted average Delivered Ex-Ship (DES) price of $7.98/MMBtu assuming Brent 3 months Mean of $65. Also if we assume optimized regasification and distribution margin of $2/MMBtu, the delivered RLNG price to the consumers is $9.98/MMBtu. Pakistan is currently experiencing a surplus of 450 MMCFD of RLNG, equivalent to 3.4 MTPA, stemming from a sharp decline in offtake by the power sector and industrial in-house captive power generation.

LNG DES Price for SPAs at $65

This demand destruction has been primarily driven by the implementation of the Captive Gas Levy Act, 2025, which has significantly raised the effective tariff for captive gas consumption to over $15/MMBtu—an economic distortion of colossal scale. Also the power sector energy mix has moved away from LNG to cheaper alternatives like Coal Nuclear Hydro and Solar. The Grid Transition Levy Act, introduced under IMF-directed reform, has further contributed to this distortion.

By setting the captive gas tariff well above the marginal cost of RLNG (assumed here at $9.98/MMBtu, including DES and regas), the policy disrupts rational and efficient gas allocation. It is ultimately self-defeating, as the intended outcome of resource optimization is undermined by pricing out captive consumers including Cogeneration CHP plants which have the highest efficiency globally.

Aligning tariffs with marginal cost principles will enable the optimization of long-term Sale and Purchase Agreements (SPAs) and related infrastructure, strengthen fiscal discipline, and improve the commercial viability of industrial offtake.

Such realignment is also critical to advancing broader national objectives including compliance with emerging climate frameworks such as the Carbon Border Adjustment Mechanism (CBAM), and meeting targets of export-led growth and energy transition.

The systemic impact of this misaligned structure is now evident: Demand destruction of 250 MMCFD of RLNG—contracted on a take-or-pay basis—has occurred. Once captive consumers are forced to switch to alternative fuels or shift to an unreliable, unaffordable, and inefficient national electricity grid, total demand destruction may reach 400 MMCFD, equivalent to 48 LNG cargoes annually, with no consumer willing to pay the full price of RLNG.

Diversion of surplus 400 MMCFD RLNG to low-paying residential segments imposes an annual fiscal burden of nearly PKR 464.5 billion (USD 1.6 billion RLNG diversion cost) in the form of cross-subsidization by other consumers. Circular debt in the gas sector has exceeded PKR 2.7 trillion, while persistent liquidity constraints have undermined upstream investment flows and deepened reliance on high-cost imported fuels. Instead of rewarding productivity and efficiency, current policy penalizes the most efficient CHP consumers and exacerbates systemic inefficiencies. In this context, reclassifying CHP-based captive generation as “industrial consumers” under the gas tariff framework is an economically rational correction.

This step would realign tariffs with the principles of cost reflectivity, operational efficiency, and sectoral productivity—ensuring that pricing signals are not distorted and that pricing is based on sound economic principles. It will address the surplus RLNG and the large diversion cost, which now exceeds USD 1 billion in the SNGPL system, and improve revenue across gas utilities and upstream producers, easing the liquidity crisis.

It will also support compliance with climate targets—such as carbon adjustment mechanisms—through the continued use of low-emission, high-efficiency CHP systems, many of which are already integrated with solar PV. It would further enhance the competitiveness of export industries, particularly textiles, by enabling climate-aligned production essential for maintaining market access and supporting employment-intensive industrial growth. To realize these outcomes, the following action is essential:

Recent Posts

News

Blog

Have Any Question?

- +92 51 2726971

- info@ptc.org.pk