Annual Meeting of Pakistan Textile Council – 30th August 2025 – Karachi

Reclassify or Collapse: Why Pakistan Must Protect Its Most Efficient Gas Combined Heat And Power Industrial Consumers

admin

June 7, 2025

Blog

Writer: MR. ASIM RIAZ AN ESTABLISHED ENERGY EXPERT, M.PHIL. STRATEGIC STUDIES NDU,MASTERS IN ENERGY MANAGEMENT CIIT, B.SC. (MECHANICAL) UET, BS. MATH-PHYSICS PU.

Pakistan’s current energy policy and regulatory framework reflects a significant departure from the principles of efficiency, financial sustainability, and integrated planning. The uniform application of the Captive Gas Levy—without differentiation based on end-use efficiency or utilization rates—has introduced substantial economic distortion and resulted in inefficient resource allocation.

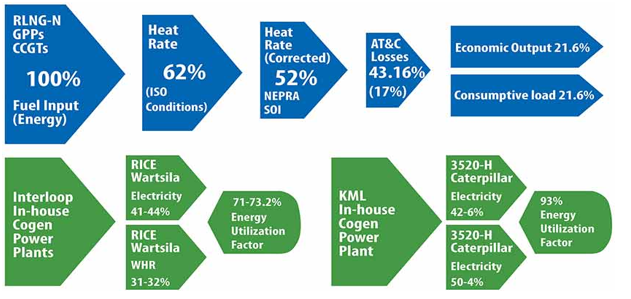

This approach has adversely impacted Combined Heat and Power (CHP) systems, which are the most efficient among all gas/RLNG consumers and add maximum economic value per MMBtu. With energy utilization rates exceeding 80%, CHP systems outperform even the latest RLNG-based Combined Cycle Gas Turbines (CCGTs), whose net efficiency falls below 43%—a gap that widens further when Pakistan’s 26% aggregate technical and commercial (AT&C) losses are taken into account.

The systemic impact of this misaligned structure is now evident: Demand destruction of 250 MMCFD of RLNG—contracted on a take-or-pay basis—has occurred. Once captive consumers are forced to switch to alternative fuels or shift to an unreliable, unaffordable, and inefficient national electricity grid, total demand destruction may reach 400 MMCFD, equivalent to 48 LNG cargoes annually, with no consumer willing to pay the full price of RLNG.

Diversion of surplus 400 MMCFD RLNG to low-paying residential segments imposes an annual fiscal burden of nearly PKR 464.5 billion (USD 1.6 billion RLNG diversion cost) in the form of cross-subsidization by other consumers. Circular debt in the gas sector has exceeded PKR 2.7 trillion, while persistent liquidity constraints have undermined upstream investment flows and deepened reliance on high-cost imported fuels. Instead of rewarding productivity and efficiency, current policy penalizes the most efficient CHP consumers and exacerbates systemic inefficiencies. In this context, reclassifying CHP-based captive generation as “industrial consumers” under the gas tariff framework is an economically rational correction.

This step would realign tariffs with the principles of cost reflectivity, operational efficiency, and sectoral productivity—ensuring that pricing signals are not distorted and that pricing is based on sound economic principles. It will address the surplus RLNG and the large diversion cost, which now exceeds USD 1 billion in the SNGPL system, and improve revenue across gas utilities and upstream producers, easing the liquidity crisis. It will also support compliance with climate targets—such as carbon adjustment mechanisms—through the continued use of low-emission, high-efficiency CHP systems, many of which are already integrated with solar PV. It would further enhance the competitiveness of export industries, particularly textiles, by enabling climate-aligned production essential for maintaining market access and supporting employment-intensive industrial growth. To realize these outcomes, the following action is essential:

Recent Posts

News

Blog

Have Any Question?

- +92 51 2726971

- info@ptc.org.pk